Trial and Order

The charge on your credit card statement will serve as your receipt.

Yes, we have a Macintosh version of the software.

It runs natively — no need for Parallels or other Windows emulation.

You may open on your Macintosh files you created on Windows, and vice versa.

And you may upload and download between the Mac version and the Cloud.

We do offer the option of charging monthly, and you may cancel your subscription at any time, but we do not support “suspending”a subscription.

The reason for this is that it would not be viable for us, either economically or administratively, because many people would call us to suspend when they have a dry month, then call again to resume when they have a busy month.

The set-up fee is $99, which is 1-2 months’ subscription charges.

If you know that you will not be using the software for more than two months, you may cancel, and then resume later and pay the one-tine charge again.

We do not encourage this, as we will incur the administrative costs of suspending and resuming the subscriptions if you do that.

But we do allow it.

We thank you for your understanding in this regard.

If you have not had enough time to evaluate the software during the free trial, we invite you to send us an email at support@familylawsoftware.com, requesting us to extend the trial.

Both cost about the same, and both do child support and temporary spousal suport, but Family Law Software does much, much more.

Key features include:

- I&E and A&D Disclosures, with easy footnoting capability.

- Family Law Judicial Council Forms.

- Calculation of fair (not formula!) permanent spousal support.

- Spousal support after-tax calculation.

- Property Division seamlessly integrated.

- Defined benefit pension valuations, actuarially accurate.

Click here for more information.

Click here to download a free trial.

Family Law Software is both easier and more powerful. Specifically:

- Family Law Software is easier to learn and easier to use.

- Family Law Software has all the key entries for Florida Child Support on a single screen.

- Family Law Software makes it very easy to see the results of the alternative methods with split custody.

- Family Law Software is more stable (very rarely crashes).

- In particular, customers have told us that Family Law Software handles mortgages much better.

- Family Law Software’s Florida Financial Affidavit looks better.

- Family Law Software has a worksheet for modifications and also generates the Income Deduction Order (IDO) and Income Withholding Order (IWO).

- Family Law Software generates both the official child support guideline form and the DPA guideline form.

- Especially with high income families, Family Law Software’s tax calculation is more accurate, because we automatically include the alternative minimum tax.

- Family Law Software desktop installs via download and is easy to install on multiple computers (no charge for paralegals or administrative assistants).

- Family Law Software desktop runs on both Windows and Macintosh.

You will see customer comments, some of which compare Family Law Software to DPA here:

Customer Comments

In our experience, virtually every DPA subscriber who has tried Family Law Software has switched to Family Law Software.

You may see for yourself, by downloading a free trial copy of Family Law Software here.

Download free trial

Family Law Software is a much more complete solution for the Family Law practitioner. Specifically:

- Family Law Software’s property division is completely integrated and easy to use. No export/import needed.

- On the Case Information Statement (CIS), Family Law Software allows you to print footnotes with each line item from within the software — no need to print to a word processor first to add footnotes.

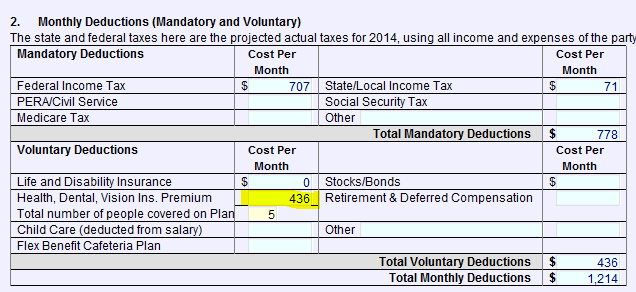

- Family Law Software performs detailed tax calculations for the current year. This allows you to give accurate budget estimates for all clients.

- Family Law Software contains an easy-to-use calculation of the amount of spousal support needed to cover a recipient’s budget.

- Family Law Software contains an easy-to-use calculation of the amount of spousal support needed to reach a 50/50 division of cash after taxes.

- Family Law Software generates a defined pension benefit valuation that is as actuarially accurate as any appraiser.

- Family Law Software allows you to do cash flow projections for up to 50 years in the future.

- Family Law Software has numerous charts and graphs for such things as Income after support and taxes, Alimony Needed, Who Should Claim Exemptions, Best Filing Status, and more.

- Family Law Software runs locally, so it is very fast, but data files can be stored in DropBox, Google Drive, Microsoft OneDrive, or any other cloud folder system that integrates with Windows and Macintosh. So you get the best of both worlds: speed of operation plus accessibility of files from anywhere.

Family Law Software is also easier to learn and use. For example:

- Family Law Software has all the key entries for the Child Support calculation on a single screen.

- Family Law Software installs via download and is easy to install on multiple computers (no charge for paralegals or administrative assistants).

And one final bonus:

Family Law Software runs on both Windows and Macintosh!

You will see customer comments, some of which compare Family Law Software to EasySoft here:

New Jersey Customer Comments

You may download a free trial copy of Family Law Software here.

Download free trial

Family Law Software is both easier and more powerful. Specifically:

- Family Law Software is easier to use.

- Family Law Software has all the key entries for the Child Support calculation on a single screen.

- Family Law Software contains an easy-to-use calculation of the amount of spousal support needed to cover a recipient’s budget.

- Family Law Software contains an easy-to-use calculation of the amount of spousal support needed to reach a 50/50 division of cash after taxes.

- Family Law Software’s equitable distribution is completely integrated and easy to use.

- Family Law Software has much more detailed budgeting and much more complete data entries for the tax calculation.

- Family Law Software has the capability for clients to enter their information online and send it electronically.

- Family Law Software generates a defined pension benefit valuation that is as actuarially accurate as any appraiser.

- Family Law Software allows you to do cash flow projections for up to 50 years in the future.

- On the financial form, Family Law Software allows you to print footnotes with each line item.

- Family Law Software has numerous charts and graphs for such things as Income after support and taxes, Alimony Needed, Who Should Claim Exemptions, Best Filing Status, and more.

- Family Law Software does get the same child support result as FinPlan, given the same inputs.

- Family Law Software installs via download and is easy to install on multiple computers (no charge for paralegals or administrative assistants).

- Family Law Software runs on both Windows and Macintosh.

In our experience, virtually every FinPlan subscriber who has tried Family Law Software has switched to Family Law Software.

You may see for yourself, by downloading a free trial copy of Family Law Software here.

Download free trial

Family Law Software is a much more complete solution for the Family Law practitioner. Specifically:

- Family Law Software has an equitable distribution worksheet that is completely integrated and easy to use.

- Family Law Software performs detailed tax calculations for the current year. This allows you to give accurate budget estimates for all clients.

- Family Law Software has numerous charts and graphs for such things as Income after support and taxes, Alimony Needed, Who Should Claim Exemptions, Best Filing Status, and more.

- Family Law Software contains an easy-to-use calculation of the amount of spousal support needed to cover a recipient’s budget.

- Family Law Software contains an easy-to-use calculation of the amount of spousal support needed to reach a 50/50 division of cash after taxes.

- Family Law Software generates a defined pension benefit valuation that is as actuarially accurate as any appraiser.

- Family Law Software allows you to do cash flow projections for up to 50 years in the future.

- Family Law Software runs locally, so it is very fast, but data files can be stored in DropBox, Google Drive, Microsoft OneDrive, or any other cloud folder system that integrates with Windows and Macintosh. So you get the best of both worlds: speed of operation plus accessibility of files from anywhere.

Family Law Software is also easier to learn and use. For example:

- Family Law Software has all the key entries for the Child Support calculation on a single screen.

- Family Law Software installs via download and is easy to install on multiple computers (no charge for paralegals or administrative assistants).

And one final bonus:

Family Law Software runs on both Windows and Macintosh!

You will see customer comments, some of which compare Family Law Software to SupportCalc here:

Pennsylvania Customer Comments

You may download a free trial copy of Family Law Software here.

Download free trial

This can happen in several situations.

Macintosh

If you are using the Macintosh edition, you do need a KeyCode for the trial version.

For all trial users, the KeyCode is “TRIAL” (in all capital letters).

Prior Users

If you have previously been a subscriber, you may download the trial edition only if you “start from scratch.”

To do that, uninstall the software from your computer and remove the Family Law Software folder.

To uninstall, in Windows, click the Windows “Start” Button, select Family Law Software, and then select “Uninstall Family Law Software.”

To remove the Family Law Software folder, click the Windows “Start” button, select My Computer, navigate to My Documents, and drag the Family Law Software folder to the Recycle bin. Or, right-click on the Family Law Software folder and select “Delete.”

Other Situations

If you are trying the software for the first time, on Windows, and you get that message, please contact us and let us know. We will make sure you can get up and running.

Click here to go to the Contact Us page

Check to see whether you have entered a KeyCode. This will be on the Files & Settings > Open/Save/Send tab, at the top.

If you have not yet entered the KeyCode:

You need to enter your KeyCode into the software.

If you know your KeyCode, click Files & Settings > KeyCode/Account > New Keycode.

If you do not know your KeyCode, click Files & Settings > KeyCode/Account > Download Keycode.

If that does not work, click Files & Settings > KeyCode/Account > Request Keycode.

If that does not work, click here and request your KeyCode.

If that does not work, contact us to ask.

If you have already entered a KeyCode:

If you have already entered your KeyCode, try entering your KeyCode again, following the steps above.

If that does not work, contact us.

The IDFA free trial is a limited-time free trial to allow you to complete the IDFA training course.

Because this is downloaded software, we do not know when you start using it, or even if or when you download it.

Therefore, we start your trial period running on the date you receive the e-mail from us. (This is usually around the date you sign up for the IDFA course.)

The free trial is a special limited offer, and we are not able to grant extensions.

If you are not able to complete the training course during the free trial period, you can use a 2-week free trial version to continue and complete your training.

If you are not able to complete the software part of the training during that 2-week free trial period, you can simply download another free trial.

One thing of which to be aware is that, if you start a case in one 2-week free trial version, you may not be able to open that case in a subsequent free-trial version.

If you are not able to continue working in free trial versions, you can subscribe to the software.

We offer a six-month full-money-back guarantee, so you may cancel and get a refund during that six-month period if you wish.

So if you want to use the software only to complete the course, you may do so, then cancel for a full refund (as long as it is within the six month period).

Question: What are the key license terms?

Answer:

- The software is month-to-month and requires no contract.

- Tech support is free and included in the cost of the license.

- Software updates incur no additional charges.

Additional terms are specific to the edition:

Firm Edition

- Each attorney in the firm needs a license.

- All paralegals and staff receive free licenses.

Cloud Edition and Basic Edition

- The licensee may share their license with staff, but only one person may be logged in at a time.

Full Edition (Desktop)

- The software may be installed on multiple computers that are used by the licensee.

- Each professional that uses the software should have a license.

- Paralegals and assistants may use the software under an attorney’s license. They install on their computers and use the attorney’s name, email, and KeyCode.

Our ironclad subscriber guarantee: If dissatisfied for any reason, cancel within 2 months for a full refund. After that, your contract is month-to-month with no contract or obligation. You may cancel at any time.

The desktop software runs on Windows and Macintosh computers.

It is downloaded from the Internet and then runs locally on your computer.

The Windows software takes about 125 megabytes (MB) on disk.

The Macintosh software takes about 500 megabytes (MB) on disk.

No emulator is required for the Macintosh version. (You do not need VMWare or Parallels.)

The requirements of your computer are as follows:

Windows

The Windows version runs on Windows 11, Windows 10, Windows 8, Windows 7, or Vista.

Macintosh

The software runs on Macintosh operating systems including and after Macintosh OS X 10.13 (High Sierra, released in 2017).

Windows Server

The software does run successfully in a Windows Server environment.

Citrix

The software does run successfully in a Citrix environment.

The Cloud software runs in Chrome, Brave, Firefox and Safari browsers.

We charge a set-up fee for two reasons.

1. Tech support. New subscribers tend to require more tech support, so this charge helps to cover that cost.

2. No contract. We have a “no contract” policy, which means that you may cancel at any time. This is a great benefit. However, some of our subscribers who pay monthly, who do not do much family law work, might be tempted to subscribe in January, cancel in February, subscribe in March, cancel in April, and so on. Administratively, we are not set up to be able to handle this kind of activity. And economically it would not be viable for us. So another reason for the one-time charge is to put a cost on this kind of switching.

We appreciate your understanding.

We really do hope you choose to subscribe.

And we would like to emphasize that if you do subscribe, we have a two-month full money-back-guarantee, a guarantee which covers the set-up fee as well.

So there is no risk in giving it a try. And if you don’t think it is well worthwhile, you have two full months in which to cancel for a full refund, again, including full refund of the set-up fee.

We get many requests to waive the set-up fee, for all kinds of reasons, many of them quite reasonable.

We have a set-up fee for two reasons.

First, we allow people to cancel at will. If people did not have a set-up fee, they would cancel when they did not have work, and resubscribe when they did. Administratively, that would be more than we can manage. Also, economically it would not be viable for us.

Second, technical support tends to be higher at the beginning of a subscription, and the set-up fee helps us compensate for that fact.

If we granted any waivers, that would not be fair to all the similarly-situated people who paid the fee.

Also, we would have to decide on a case-by-case basis whether to waive the set-up fee. This would represent an insupportable burden on our time.

Sometimes people intended to sign up at a conference where we were waiving the set-up fee, but did not quite decide in time.

If we waived the fee for those people, it would not be fair to the people who did take the plunge at the conference itself.

We allow people to cancel the software at any time. The caveat to that is that, when people re-subscribe, we charge the set-up fee again.

Again, if we waived the fee in that case, we would be incurring the costs described above, and it would be a slippery slope to the on-again off-again subscription arrangement that is not sustainable for us.

Our goal is to make the set-up fee be the smallest possible amount that would prevent the constant cancel-and-resubscribe, and that yields some return to cover the greater tech support costs.

We hope that this amount does not deter you from subscribing to our great software!

We strongly believe that even in one or two cases per year, the software more than pays for itself in the enhancement of the quality of work you do, the efficiency savings, increased profitability, and referrals from happier clients.

Getting Going

When you are starting the software, if you get the message saying “Family Law Software has encountered a problem and needs to close,” it is because a file did not download completely or has become corrupted.

Just download the software again, starting at the link below, and you should be fine.

Download Professional Edition

If this download seems to happen instantaneously (that is, in 3 seconds or less), then the software did not actually download again. You still have the faulty download.

This can happen because your browser is insisting that the software has already been downloaded, and so you could not have wanted to download it again.

In that case, if you restart your computer, that should clear your browser’s memory of having downloaded the software before, and this should enable you to download it again.

As you probably know, downloading is just the first step. In order to complete the installation, you need to run the download. You may be prompted to allow Family Law Software to make changes to the computer. Allow that. Then you should see this screen:

Click on it, then on our license agreement, Next, Next, and then Finish.

At that point, the software is installed and you should be good to go.

Google Chrome attempts to be “smart,” and not download a file that has already been downloaded.

Instead, it copies the file from a place it had already been saved (“cached’) on your computer. When it does that, you do not get the latest update.

Because it looks like it is downloading, it is hard to tell. (If it really is downloading, you can see the megabytes tick upward. If it is just copying a saved file, the download appears to be instant.)

In any event, the procedure described below will force Chrome to download the latest Family Law Software.

1. Click the “Settings” button in the upper right-hand corner of the browser. The “Settings” button looks like the image below:

2. Select “More tools >Clear Browsing Data.”

3. Unclick all of the checkboxes, except “Cached images and files,” as shown below:

4. Click “Clear browsing data,” as shown above.

After you have done these steps, return to the Family Law Software download page, and download the software again:

Click here to go to the Download page.

Simply click here and follow the instructions to download and install.

You may install this version right over your existing version.

As you probably know, downloading is just the first step.

In order to complete the installation, you need to run the download. You may be prompted to allow Family Law Software to make changes to the computer. Allow that.

Then you should see this screen:

Click on it, then on our license agreement, Next, Next, and then Finish.

At that point, the software is installed and you should be good to go.

To see if we have posted a later version than the one you are using, click the Files & Settings tab in Family Law Software. Then click the “Update Software” link, and follow the instructions.

You can make the screen fonts larger.

Click Files & Settings > Settings >System Options > Use larger fonts for screen display.

Once you have checked this box and clicked OK,you have to exit the software and then start the program again.

This makes the fonts larger on-screen, but it does not affect the fonts that are used in printing.

The fonts will remain larger each time you use the program in the future, unless you return to this location and clear that checkbox.

There is no way to change the fonts that are used in printing.

This is because most of the outputs are carefully spaced with respect to the page, and we cannot increase the font size and retain the page layout.

In Windows 10, you can make all the fonts in the system larger. To do that, click Windows Start button > Settings > System > Display > Change the size of text, apps, and other items.

This FAQ is for the situation where you are getting a new computer (PC or Macintosh) and want to install the software on it and move all of your files over.

It is also helpful if your computer has crashed, and you are moving to a new computer for that reason. (In that case, skip the parts that do not apply.)

Here are the steps to follow.

1. Back up existing client files.

The first step is to back up all of your client files.

If the files are already backed up on a network, you can skip this step.

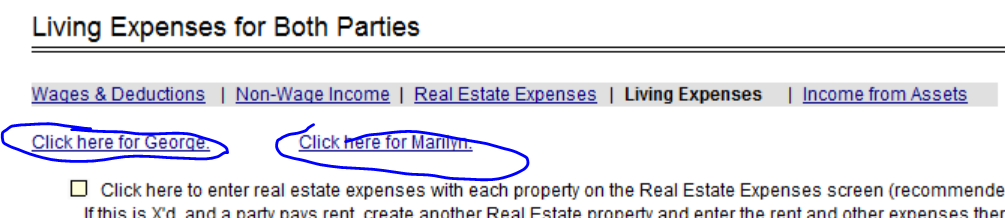

PC: If the files are on your local hard drive only, find the folder where they are stored. To do this, look at the Files tab. You will see the location near the top of the screen, as shown below:

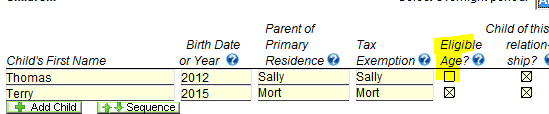

In the image above, the current folder is “Family Law Software” within a Dropbox folder.

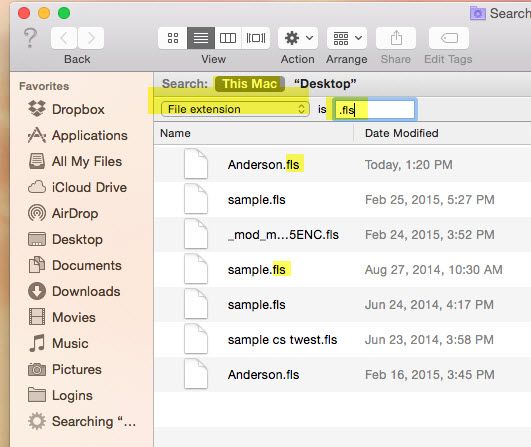

Close Family Law Software, and use Windows “My Computer” to navigate to that folder. Then drag those files to a place you will be able to access from your new computer. The key thing to know is that all of the Family Law Software data files have the extension “.fls”.

The destination folder, which you will be able to access from your new computer, could be on a thumb drive (aka flash drive) or other external hard drive.

Or, create a DropBox, Google Drive, OneDrive, or similar “cloud drive,” and save the files there.

If the files are already external to your computer — such as on a Dropbox, Google Drive, OneDrive, or network drive — you can skip this step.

2. Additional Instructions for Macintosh.

If you can find your files using Finder, then follow the steps above.

If you can not find your files using Finder…

Click here for an FAQ on creating a folder you can locate using Finder

Once you create that folder, it may be necessary to open the existing files one at a time and then save them into that folder using “Files tab > Save As…”

You can click Files tab > Restore, and restore the most recent version of each file. They will go into your new default folder. You can change the name on each one to delete “_Restored” before they are saved.

If for some reason Restore does not work, another way to get to all your old files would be to go back to the original file location. To do that, click Files & Settings > Settings > Change Default Folder, as shown below.

Once all the files are all in a place you an access using Finder, close Family Law Software, and use Finder to drag the files to a place you will be able to access from your new computer. This can be a thumb drive, Dropbox, or Google Drive folder.

3. Write Down Your KeyCode.

You can find your key code on the old computer by clicking the Home tab > Getting Started screen, and looking at the bottom of the screen.

Write it down. (If you can not do this, it is OK. Keep going.)

3. Install the software on the new computer.

To install the software on the new hard drive, go to our web site, www.FamilyLawSoftware.com, click the Current Subscribers > Download Latest Version, and follow from there. Or just click here:

Click here to download the latest version

4. On your new computer, start Family Law Software and set the default folder.

Double-click the icon on your desktop.

During the installation of Family Law Software, you will be asked for the default folder.

If you are using the software on a network, specify the default folder to be the folder on the network you are currently using.

If you are using Dropbox, Google Drive, OneDrive or a similar cloud-based folder, specify that.

If you are not using a network folder, perhaps you would want to take this opportunity to do that.

If you are running the software on Macintosh, we recommend that you set a folder you can find in Finder, Dropbox, Google Drive or similar cloud-based folder.

Click here for an FAQ on creating a folder you can locate using Finder

Or, accept the default option, which is the Documents > Family Law Software folder on the local hard drive.

(You may change the default folder at any time, by clicking Home tab > System Info > Click here to change the default folder.)

The first time you start Family Law Software, you will be asked for your KeyCode.

If you have not written down your KeyCode, you may start the new software and click Files & Settings > KeyCode/Account > Download KeyCode.

If that does not work, try Files & Settings > KeyCode/Account > Request KeyCode. If that does not work, you may e-mail us or call us to request your KeyCode.

5. Move your existing files over.

If you have a network, or you are using Dropbox, Google Drive, OneDrive or a similar cloud-based folder, and the files are still there, there is nothing to do in this step.

Otherwise, if you backed up the files, drag them into your new folder on your new computer, using Windows “My Computer” for Windows or Finder for Macintosh. The files you want are those that end with “.fls”.

If you are storing client files in client folders, drag the client folders over to your new default folder.

6. That’s it.

You should be all set on your new computer.

If you have any questions, please do not hesitate to contact us.

.

Family Law Software has a standard “Uninstall” procedure, which works as follows:

1. Click the “Start” button on your Windows desktop.

2. Select “All Programs” and find Family Law Software.

3. Select “Family Law Software” then select “Uninstall Family Law Software.”

As an alternative…

1. Click the “Start” button.

2. Select “Control Panel.”

3. Select “Add or Remove Programs.”

4. Find “Family Law Software.”

5. Select “Family Law Software” then follow the directions to remove Family Law Software.

Please note that the uninstall will remove the program, but it will NOT remove the data files or the program folder.

If you wish to remove the data files and program folder:

1. Copy your data onto a floppy disk or another computer. On the Files & Settings > Open/Save/Send, at the top, you can see the folder where your files are stored.

2. Delete those files.

3. Delete the folder in which those files were stored.

4. Delete the Documents \ Family Law Software folder, if you have not already done so.

5. Delete the c:\Program Data\FLSPlan folder.

The PC version of Family Law Software does not run on phones, iPad, or Tablets.

Follow these steps:

1. Make sure your KeyCode file is named keycode.lst

2. Create a folder on the server for the file to reside in. You can create the folder in the same directory that the program installed in, or another folder as long as it is accessible to be read by Family Law Software when it starts up. Give the folder any name you like. “FLS Admin,” for example, is fine.

3. Place the keycode.lst file into the folder you created in step 2 above.

4. Create a plain text file (e.g., using Windows Notepad) called flsadmin.ini, with the following content (assuming you placed the keycode.lst file into the folder c:\temp):

[ADMIN]

AdminKeycodeFolder=c:\temp\

5. Copy this file to c:\program files (x86)\Flsplan\

6. Install the Family Law Software program to the server (unless you previously installed it).

7. Start Family Law Software and click Home tab > System Info > Click here to set System Administrator Options.

8. A dialog will open. Find the option for “Master KeyCode List.” Click “Browse,” and Navigate to the folder you just created. Click OK.

9. On your server, create a folder client files. This folder should be accessible to all users with full read/write permissions for all users. Name the folder anything you like. “Family Law Software Files,” for example, is fine.

10. Return to Family Law Software. On the Home tab > Sytem Info screen, click “Click here to specify Default Folder.” Navigate to, and select, the folder you just created.

11. To test: Click Files tab > New. Create a file and enter some data. Exit Family Law Software. Start Family Law Software agan, and click Files tab > Open. You should see the file. Open it. If your data is there, you are all set.

You, or your paralegal or assistant, may download the software here:

Click here to download Family Law Software

When the software first starts, it will ask for a name and KeyCode.

Enter your name and KeyCode — not that of the paralegal or assistant.

You can find your KeyCode at the top of the Files & Settings > Open/Save/Send screen in the software.

You should also make sure that every computer’s Family Law Software folder for storing client files is the same.

That way, you will be able to work on the same files.

For more information on storing files, click the links shown below:

Where can I store client files?

How can I access files from anywhere (the Cloud)?

To configure Family Law Software to work in the Citrix environment, you will want to adjust the software’s Administrative Settings:

There are two folders to set up:

1. A “working folder” for information identifying the attorneys; and

2. A “default folder” for client data.

Attorneys need full read/write access to each folder. We discuss each folder below:

1. Networking folder.

a. Create a folder on the drive where that you wish to store the information that will identify the attorneys. In Family Law Software, we call that the “working folder.” You can name it, for example, “Family Law Software Working.”

b. Download and install Family Law Software.

Click here to go to the download screen.

c. Open the software and click Files & Settings > Settings > System Administrator Options. You will see the screen shown in the image below

d. In the Administrator Settings dialog (shown below), enter the Working Folder in the section entitled “Central Server Configuration.”

e. Click the OK Button

f. You will see a confirming dialog. Click “OK.”

g. Your Working Folder is now set up.

2. Default Folder.

Create a folder on the server for client data. You might call it “Family Law Software Client Files.”. Be sure that users will have full read/write access to the folder.

Start Family Law Software, and click Files & Settings tab > Settings > Change Default Folder.

Navigate to the folder you created above.

3. KeyCode File

Next, you will need a file called “Keycode.lst.”

Get this file from Family Law Software. Request it from tech support (support@FamilyLawSoftware.com).

The KeyCode.lst file will identify each licensed user.

When you get this file, return to the Administrator Settings dialog (illustrated above). Enter a path for the KeyCode file under the heading “Master KeyCode List.” Typically, this path will be the the folder where the program is installed.

Then place the file in that folder.

At this point, you should be all set up.

Most likely, the program is currently running, or it is still in memory from an earlier time running or from an earlier attempt to install.

Here are the steps you can take to resolve the problem:

1. If the program is currently running, simply exit the program and then click “Retry” on the installation dialog. If you have already clicked “Abort” on the installation dialog, just try installing again at this point.

2. If that does not work, you can start Windows Task Manager, by right clicking in the Task Bar, and selecting Task Manager. Then find any or all of the Family Law Software, FLSPlan and FLSPro processes, and remove them from memory. (To remove them from memory, right-click the line where you see Family Law Software, FLSPlan or FLSPro, and click End Task.) Then go back and click “Retry” on the installation dialog. If you have already clicked “Abort” on the installation dialog, just try installing again at this point.

3. If that does not work, or you could not figure out Task Manager, the next thing to try is click “Abort” on the installation dialog, restart your computer, and download and install Family Law Software again.

4. If that does not work, it may be that you do not have the administrative permission to save information (“write”) on the hard drive. In that case, speak with the office administrator about what to do next. For example, you may be able to log in to the computer as an “Administrator,” which would allow you to install the software.

Most likely, this message is generated by your anti-virus software. We have seen this especially with the free programs like Avast, Panda, AVG and so on.

Just temporarily turn off the anti-virus software and start the program normally.

If you do not know how to turn off the anti-virus program, ask your IT person, check the anti-virus company’s web site, or call the anti-virus company’s tech support.

Typically, you are having this problem because of a corporate firewall.

Unfortuantely, if your corporation’s firewall is blocking e-mail from going out from Family Law Software, there is nothing we can do to get the e-mail to go out.

However, you do have an alternative.

Anything that we send from within the program, you can send as an attachment.

1. Documents.

First, print the document to a PDF, by clicking the PDF button at the top of the screen.

To send a PDF to a client or to another professional, go to your regular e-mail program, address an e-mail to the recipient, and simply attach the PDF.

Look for the PDF in your Family Law Software current folder. You will see what your current folder is at the top of the Files & Settings > Open/Save/Send screen in Family Law Software.

The PDF may be in a folder with the client’s name within the current folder.

2. Client data file.

Similar to PDF, you can attach the client data file to an e-mail.

The client data file will also probably be in your current folder, or in a folder with the client’s name within the current folder.

It has the exetnsion “.fls” at the end of the file name.

The recipient will only be able to open the Client Data file if he or she has Family Law Software (licensed, client, or trial edition).

First, check your spam folder.

If you do not find it, we can look try to look up your KeyCode for you. Do the following:

1. Start Family Law Software.

3. Click Files & Settings > KeyCode/Account > New KeyCode > Get Keycode.

5. If that does not work, contact us to ask.

This may be a permissions/security problem.

You may be able to fix it with the following steps:

1. Open File Explorer (called Windows Explorer in Windows 7 and earlier). You can do this by holding down the Windows key and pressing the letter “E.”

2. Navigate to c:\Program Files (x86)\FLSPlan. Do this by finding the folder icon labeled “Hard Drive C:” (or similar language) and double-clicking it. Then find the folder icon labeled “Program Files (x86)” and double-clicking that. Finally, find the folder icon labeld FLSPlan, and double-click that.

3. Find the file named FLSPlan.exe.

4. With your mouse, right-click that file.

5. A menu will pop up. Select “Run as Administrator.”

That may fix the problem.

If not, please contact technical support.

Click here to e-mail technical support

Thank you for subscribing to Family Law Software! Here is how to get going.

2. Run (double-click if necessary) the downloaded file, FLSPro.exe, to install the software on your computer. If you can not find the downloaded file to run in your browser window, press Ctrl+J in your browser. In several browsers this brings up a list of downloaded files. Run “FLSPro.exe.”

3. Double-click the icon on your desktop (Windows) or Applications folder (Mac) to start the software. (In the Mac, you can drag the icon from the Applications folder to the icon bar at the bottom. Then it will start from the icon bar.)

4. In Family Law Software, click Files & Settings > KeyCode / Account > New KeyCode.

5 .Fill in the name and KeyCode information exactly as sent to you in the e-mail you received from us. Dashes are required.

6. To get oriented, you may wish to view our training videos:

Click here to view training videos

On the videos page, find your state. Financial professionals from all states should click the link for financial professionals.

7. We invite you to sign up for a free online monthly Webinar series.

Click here to sign up for free Webinar.

Again, welcome to Family Law Software!

This is NOT a trojan. The identification by Malwarebytes is a “false positive.” Here are the steps to follow to let Malewarebytes know this::

1. Start Malwarebytes. Right-click the icon, and select Open Malwarebytes Anti-Malware.

2. Clear all checkboxes next to Debenu items.

3. Click “Next”

4. Select “Ignore Always.”

There is no virus in Family Law Software.

For a reason unknown to us, some anti-virus programs, including AVG, Avast, and a few other free anti-virus programs report Family Law Software as a threat, or the FLSPro.exe installer as a possible Trojan.

You can ignore these warnings.

Family Law Software is not a threat and does not have a virus.

If these warnings are preventing you from installing the software, we suggest that you turn off the anti-virus software during the installation process.

If you cannot do that, you can “whitelist” Family Law Software with your anti-virus software or firewall.

You want to indicate that the following are safe and permitted:

Files:

FLSPro.exe

FLSMac.dmg

Web pages:

/download_pro_product.html

Follow the steps below, and we will restore as much as possible.

1. Reinstall the Software.

Getting the software re-installed is the easy part. You can click here and download it:

Download latest version of Family Law Software

2. Enter your KeyCode.

If you do not know your KeyCode, you may request it here:

3. Restore your files.

This part is a bit more involved, and it may not work.

The software and client files are stored on a network in your office, in the cloud, or on your computer.

If you have an office network, they were probably stored in a folder on your office network. In that case, the files are probably all still there. All you have to do to point the program to that folder. To do that, click Files & Settings > Settings > Change Default Folder.

Similarly, if the files were in the cloud, with DropBox or Google Drive for PC for example, do the same thing and navigate to the drive in the cloud.

If you do not have a network, the files were probably saved on your hard drive in the folder My Documents > Family Law Software.

You should retrieve them from that folder in your office back-ups.

The files have the name you gave them, and then “.fls.”

You can use Windows “My Computer” or Macintosh Finder to drag the folders into the folder where you want them now.

If you saved the files only on the computer that crashed, and you have no back-ups, we are sorry to tell you that there is no way to recover them.

For the future, be sure you have backups!

If you get this message and you are a licensed subscriber, here are the things to try:

1. Re-enter your KeyCode.

You should have received your KeyCode from us by e-mail.

If you know your KeyCode, do the following:

1. Start Family Law Software.

2. Click Files & Settings tab > KeyCodes / Account > New KeyCode.

3. Enter your name and KeyCode with the dashes.

2. Find your KeyCode.

If your subscription is still current, but you don’t have your KeyCode, do the following:

1. Start Family Law Software.

2. Click Files & Settings > KeyCode / Account > Download KeyCode. We will try to put the KeyCode into your software for you.

3. If that does not work, click Files & Settings > KeyCode / Account > Request KeyCode. We will send the KeyCode to the e-mail address we have on file for you.

4. If that does not work, click here and request your KeyCode.

5. If that does not work, contact us to ask.

3. Renew your subscription.

Your subscription is keyed to your credit card expiration date. If your credit card has reached its expiration, you will need to give us the new expiration date.

For security reasons, we do not store credit card numbers. For that reason, just to be sure we have the right card, we will always ask for the entire card number.

We do not need the 3-digit code on the back of the card, however.

Click here to renew your subscription.

Click here for information on subscription cost and license terms.

Question: The training videos are not working for me.

Answer: The video files are located here:

Click here for training videos

If the training videos are not opening on your computer, try using a different browser.

That is, if you are using Firefox et al., try Google Chrome.

We have found that suggesting that people try a different browser seems to work and may be the fastest way to address the problem.

Macintosh-Specific questions

Here are the steps to remove Family Law Software from your Mac computer.

To remove the program but NOT the data, skip the last step.

1. If you are going to delete the data at the end, determine where your files are stored. You will see the location if you start Family Law Software, click Files & Settings, near the top, after the words, “The default folder is:….”

2. Close Family Law Software, if it is open.

3. Start Finder.

4. Click on Applications.

5. Drag the Family Law Software icon from your Applications folder to the Trash. The Trash should change its appearance and make a crunching noise.

6. Verify that the icon is no longer in the list in the Applications folder. If it is still there, drag it to the Trash again.

7. In Finder, slect the Go menu at the top of the screen. Hold down the option key on your keyboard, and you will see an option called Library.

8. Select that option. Then, under Application Support, drag Family Law Software into the Trash.

9. This will delete the program, but NOT the data. If you do want to delete the data, drag your data folder into the Trash. Typically, this will be the “Family Law Software” folder from the Documents folder. Before you do this, please back the files up somewhere, so you can access them later. We do NOT have access to files located on your Mac computer, so we will not be able to restore them for you.

Apple has dropped support for 32-bit software, which breaks support with Family Law Software for the Mac. Our consultants are working with Apple to attempt to resolve the problem, but it is not resolved yet. We do not have any guarantee that it will ever be resolved or any clear time frame for when it will be resolved, if it will. We think it is more likely than not that it will be resolved eventually, and we would offer a guess at a six-month time frame, but please understand that this is speculative at this point.

There are three known solutions to allow you to use FLS Mac on macOS Catalina. All three unfortunately have a cost: FLS Cloud ($59.95/month), Parallels w/ Windows ($79.99/year + Cost of Windows), Parallels w/ macOS Mojave ($79.99/ year).

WARNING: Family Law Software is in NO WAY affiliated with Parallels and does not provide support for the Parallels software

“

2. Close Family Law Software, if it is open.

3. Start Finder.

4. Click on Applications.

The first solution to use FLS on macOS 10.15 would be to upgrade to the of FLS and use the software online with Safari, Google Chrome, or Mozilla Firefox.

The next two solutions use a 3rd-party application called to run the FLS Mac software from a different operating system. Parallels allows you run alternative operating systems from within your default operating system. Parallels cost $79.99/year ($6.66/month) which will allow you to have all future versions or $99.99 for the current version only. Once installed, you can take full advantage of using other operating systems (Alternative macOS versions, Windows, Linux, or other).

1) Installing Parallels

5. Drag the Family Law Software icon from your Applications folder to the Trash. The Trash should change its appearance and make a crunching noise.

6. Verify that the icon is no longer in the list in the Applications folder. If it is still there, drag it to the Trash again.

7. In Finder, slect the Go menu at the top of the screen. Hold down the option key on your keyboard, and you will see an option called Library.

8. Select that option. Then, under Application Support, drag Family Law Software into the Trash.

9. This will delete the program, but NOT the data. If you do want to delete the data, drag your data folder into the Trash. Typically, this will be the “Family Law Software” folder from the Documents folder. Before you do this, please back the files up somewhere, so you can access them later. We do NOT have access to files located on your Mac computer, so we will not be able to restore them for you.

The steps to downloading the Macintosh version are as follows (you may wish to print these out):

1. Download. Click the “Accept and Download” button on the download screen.

Click here to go to the Macintosh download screen

2. Unzip. After the download completes, double-click the downloaded file “FLSMac.dmg” (or FLSMac (1).dmg, etc.). If you are using Safari, this will be in the top right-hand corner. For Chrome, this will be at the bottom left.

3. Minimize. After that runs, minimize your browser (click the yellow button in the corner).

4. Drag. You will see the Family Law Software icon and the Applications folder in a window. Drag the Family Law Software icon onto the Applications icon.

5. Dock. Go to Finder, open the Applications folder, and drag the Family Law Software icon to the Dock at the bottom of the screen. You only ever need to do this once.

6. Start. Start Family Law Software by clicking the icon in the Dock at the bottom of the screen.

You could conceivably get error messages along the way. Here are the ones we know of:

Click here if you get a message that Family Law Software is damaged.

Click here if you get a message that the identity of the developer could not be confirmed.

Please follow these steps, which we have found sometimes to be necessary, because the Macintosh’s download system does not always seem to be working correctly:

1. Delete Family Law Software. Drag the Family Law Software icon from your applications folder into the trash. If Family Law Software is in your dock at the bottom of the screen, also drag the icon from there into the trash. This will NOT affect your client files. Your client files will be untouched by this action.

2. Additional steps. Follow these additional steps to completely remove Family Law Software program (but not data files).

3. Restart your computer. Restart your computer. This resets the Macintosh’s download system, so the new file will replace the old one.

4. Download the latest Family Law Software. Download from our website, here:

Click here to go to the Download page

5. Minimize browser and drag icon. After the download completes, you need to minimize your browser (Safari, Chrome, Firefox, etc.), and drag the newly downloaded icon into the Applications folder.

6. Try a different browser. If it still is not working, try a different browser (Firefox, Safari, Chrome, etc.).

After the software is installed, you may drag the icon from the Applications folder to the Dock at the bottom of the screen.

The Catalina operating system on the Mac introduced a new security feature that requires the user to authorize any application’s access to files on the computer.

Cloud Edition questions

You may upload files from the Windows and Mac editions to the Cloud Edition and download files from the Cloud Edition to the Windows and Mac editions.

The easiest way to do that is from within the Cloud Edition.

To upload files from the desktop to the Cloud, you may do the following:

- Log in to the Cloud and click File Manager (top left).

- Click “Upload” (on the right).

- Navigate to the file on the desktop and click “OK.”

To download files from Cloud to desktop:

- Click File Manager (top left)

- On the line where the file is listed, click the three dots menu.

- Click Download.

You can also upload and download from within the desktop editions.

- Click Files & Settings > Open/Save.

- You will see buttons labeled Download, Upload, and sometimes Send Back.

- Read the help for each of those buttons for the appropriate action.

If you have many files, you must open them one at a time on your Windows or Mac desktop, and upload each in turn to the Cloud.

If you have uploaded a file to the Cloud or downloaded a file from the Cloud, you will end up with multiple versions of the file, one on the Windows or Mac desktop edition and one in the Cloud. Please be careful that you are always working in the latest version.

If you wish, you may delete the file from the Windows or Mac computer after you upload it to the Cloud (Files & Settings > Open/Save > Delete). This practice will assure that you have only one current version, and it will prevent you from entering some data in one file and other data in another file.

Family Law Software web data entry follows current best practices for secure communications, including the following:

- All data files are maintained on our Amazon S3 cloud storage servers.

- Access to the Amazon cloud storage servers is SSL protected. (SSL stands for “Secure Socket Layer,” and it is the industry standard protocol for secure communication between PC and server.)

- Every client file is password protected and accessible only with e-mail and password.

- Passwords must be of a secure nature (including both uppercase and lowercase letters, and numbers).

- When files are uploading to and downloading from the desktop software to Cloud storage, or, when saving and retrieving from the web server to Cloud storage, we use Transport Layer Security (TLS). This is the standard SSL and https with encryption certificates.

- Each client registers on our site and establishes his or her own password. This password is encrypted at the moment of creation and no one is ever able to view it. Passwords may be changed but not viewed by anyone (not even by the people at Family Law Software).

- Passwords may be changed only by someone who can log in to the client’s email (GMail, Yahoo, MSN, etc.).

- Every client data file is encrypted.

- We have removed from our data entry any fields asking for full social security number. We ask only for “last 4 digits.” Attorneys who file forms that require full SSN now have to write that information by hand on their forms.

- When a client file is transmitted to the professional, we make a copy of the file and store it in a location that is accessible only by that professional’s firm, with the same security parameters that apply to clients (SSL, encryption, password protection, and so on).

- Client data and user data are stored in separate locations on Amazon’s S3 server pool.

Here are the steps:

- Open the File Manager (top left button if in a case file).

- Click the three dots button on the line where the case is listed.

- Select “Email FLS Support.

The case will be sent along with a question you type.

There are many situations where synching would be a problem.

Here are some:

1. Two individuals could be editing different versions of the same file on the desktop. Which would we synch?

2. What would we do if a user deleted a file on the Cloud, should we delete it on the PC too?

3. What if the user is running an old PC version that has synching capability but the file is no longer compatible?

4. Users may be in a restricted environment, such as a coffee shop where email works but the Cloud does not.

5. Users may disconnect from the Internet or power off their PC in the middle of synching. That would corrupt data.

6. Users may work independently on the web and the PC. What would we do then?

Client Data Entry

Yes, they are on the Files & Settings > New Client > Paper client data sheets.

It is not possible to merge or combine two separate client files.

If the clients have already created them, you can do the following:

1. Start Family Law Software and open one of the files.

2. Minimize that window…

…get back to your desktop, and double-click Family Law Software again. This will start a second Family Law Software window.

3. Open the other client file.

4. Drag and resize the Windows so they are next to each other.

5. Go through the data entry screens, and copy and paste from the file with less data into the file with more data.

If the clients have not yet started work, it is possible to avoid creating two separate files.

Click here to see how to have two clients both enter data..

There is a way for two clients who do not live together to work on the same client data file using the Desktop (Windows or Mac) software.

(This is much easier in the Cloud software, where the parties just have to use the same e-mail and password, and not both work at the same time.)

Using the Desktop software, the first client enters her data first, then sends the file to the second client, who enters his data and sends it on to the professional.

The software was not really designed for this situation, and clients should not attempt it unless the second client in this process is comfortable with moving, copying, and renaming files on his or her computer (or can get someone who is comfortable to do it).

Here are the steps:

First Client

1. The first client downloads the desktop edition of the client software, available here: /download_client_edition.html

2. The first client enters his or her information.

3. The first client clicks the Transmit tab, then the link “If this does not work, click here.”

4. The first client enters the name and e-mail address of the second client (instead of the professional) and clicks “E-mail your file.”

If that does not work, the first client can simply send an e-mail to the second client, attaching the Family Law Software file. The Family Law Software file will be located in the My Documents > Family Law Software folder, and will have the first client’s last name + “.fls” as the file name.

If sending the file does not work on the Macintosh, and the first client can not find the file to attach, the first client can go back to the Client Edition and click Ctrl+A. This will bring up the “Save As…” dialog. Navigate to a folder that Finder can see, and save the file there.

Click here to see how to save to a folder Finder can see.

5. The second client has also installed the Desktop version of the Client Edition.

/download_client_edition.html

6. The second client starts the Desktop software and enters the first client’s name as the first party’s name (and no other data).

7. The second client exits the Desktop software.

8. Using Windows Explorer (or Macintosh finder), the second client copies the file from the first client into the folder Documents > Family Law Software. This should have the same name as the file that already exists there, and it should overwrite that file. If not, see the next item.

9. If the files do not have the same name, the second client should write down the name of the file he or she created (the first party’s last name and “.fls”), then delete that file, then rename the first client’s file to have the name that the second client’s file had. (To rename a file in Windows, right-click on the file and select Rename.)

10. The second client should start the Desktop Client Edition again. This time, the first client’s data file should open up.

11. The second client should continue. When the second client if finished, the second client should Transmit to the professional.

Although the software is currently not designed to accommodate file transfers from professional to client, it can be accomplished. The client needs to be comfortable with moving and renaming files and folders on his or her computer.

This will process work even if the client and professional have different computers (Windows versus Mac).

Here are the steps:

1. Client Software.

First, the client needs to have the Client Edition of Family Law Software.

If the client does not have the Client Software, he or she can download it here:

Click here for the Client Software

2. Sending the File.

The professional can click “Files & Settings > Save As…” to rename the file before sending it to the client.

The professional should then note the location of his Family Law Software folder.

Your Family Law Software folder is shown at the top of the Files & Settings > Open/Save/Send screen, as shown below.

The professional then can start an e-mail normally, then click the button for an attachment.

Navigate to your Family Law Software folder, and select the client’s file.

Send the e-mail to the client.

The client will receive the file as an attachment to the e-mail from the professional.

3. Client Opening the File

The client should open the e-mail and download the attached file to his or her Documents / Family Law Software folder.

The client software is designed only to work with a single file.

If the client has not already done so, the client should start the client software and enter his or her name, to cause that file to be created.

The client should then exit the software.

Using Windows Explorer, or Macintosh Finder, the client should go to the Documents > Family Law Software folder.

In that folder, the client will see both the file from the professional and the file with the client’s name that was just created.

The client should copy down on a piece of paper or document on the computer the name of the file that was just created.

The client should then rename the file that was just created to a different name.

The client should then rename the file sent by the professional to the original name of the file that was just created (and saved on paper or in a document).

The client can then start the Client Edition.

The file sent by the professional should open.

When the client is finished working, the client can transmit the file to the professional using the yellow Transmit tab at the top.

It depends whether you are using the Desktop software (Windows or Mac), or the Cloud.

Desktop Software

If you are using the Desktop software (Windows or Mac), here are the things you need to know:

1. You have to update your software in order to download Client files.

2. In the new software, there are two Download buttons, one for files started on or before February 7, and one for files started after February 7

3. If you want to send files back to clients who started their files on or before February 7 and transmitted to you, you have to re-register them first. (Registering is the process of generating an email, as you do for a new client.

4. If you want to send files back to clients who started their files on or before February 7 and did not transmit (because you “Took the file”), you do not have to re-register them first.

5. For files started after February 7, you do not have to wait for a client to Transmit. Click the “Download files started after Feb 7” button at any time.

6. For files started after February 7, the client will be able to continue working in their file after you download it. They will not be locked out. And you can then download it again and again, whenever you like.

7. After February 7, the client is never “locked out” of their file. If you Send Back a file, doing so will overwrite anything the client has done since you downloaded the file. Please be sure to coordinate with the client as to who is working in the file.

Cloud Edition

If you are using the Cloud Edition, here is what you need to know:

1. For files started after February 7, you and the client can both work in the same file. There is no more “Transmit” or “Send File Back.” This is the key improvement of this new release.

2. You can not both work in the same file at the same time. If one of you is working and the other logs on, the one who was working will be logged off.

3. For files transmitted on or before February 7, you use the Open button, as before.

4. If you want to have a file that the client can not access, simply save the file under a different name, using the Copy button.

5. For files started on or before February 7, if the client has not transmitted, the client can just log in and keep working.

6. For files started on or before February 7, if the client has already transmitted, and the client wants to keep working in the file:

a. The client should try to log in. The login will fail, but the attempt will set the client up in the new system.

b. You should Register the client again.

c. The client will get a fresh link.

d. The client will then be able to log in, and it will be as if the file was started after February 7.

7. For files started on or before February 7, if the client has already transmitted, and you have opened the file and made changes, you have to go to the Desktop software to “Send Back.” There is no longer a “Send Back” button in the Cloud version.

There are two ways that clients can coordinate to enter their data and get it to you.

1. Cloud Data Entry.

By far the easier approach is for both of them to use the Cloud Data Entry.

They just need to agree to use the same e-mail address and password.

The professional sends the “New Client” e-mail to one client, who creates the account and password.

That client then shares the log-in e-mail address and password with the other client.

The parties should coordinate so that they are not both using the software at the same time. If they try, the second party to log in will bump the first party off.

2. Desktop Software Data Entry.

The other possibility is that both spouses work in the desktop Client Edition software.

Click here to see how both clients can work in the desktop Client Edition software.

Please note that in either case, the parties will have the ability to change the numbers that were entered by the other party.

So they need to agree about who will be entering what.

For example, one party could enter her expenses and the asset and liability information.

And each party could enter his or her expenses.

.

If you are a professional using the software, you may request that your clients get the Client Edition for free.

There are two versions of the Client Edition available:

1. PC software.

2. Web Data Entry.

Both editions have the same data entry fields.

Once the PC software is downloaded, no Internet connection is necessary. The file may be sent to the professional, and the professional may send the file back to the client.

The Web Data Entry may be completed on any device, including an iPad or a phone. Once the Web Data Entry file is transmitted to the professional, however, the professional may not send the file back to the client.

To get the client started, click Files & Settings > Open/Save/Send > New Client.

This will generate an email to the client. The client will register online (even if the client is using the PC software). This online registration will facilitate the transmission of the file back to the professional.

The client will then be able to choose which method the client wishes to use (PC Software or Web Data Entry).

When the client is finished, the client will transmit the file to the professional.

The professional will then start his or her software, and click Files & Settings >Open/Save/Send > Download.

This FAQ concerns situations in which you are trying to enable a client to enter his or her data, and you used the Files & Settings > Open/Save/Send > New Client screen.

If you get an error message from the software, indicating that the e-mail could not be sent, it may be that our online database has not yet been updated with your information.

If you just signed up for Family Law Software, please wait an hour or two, and try again.

If you signed up before today, and the e-mail could not be sent, please check your Internet connection.

If you are connected, please ask your IT person to “whitelist” the web site FLSGo.com.

If the e-mail appears to have been successfully generated, but the client does not report receiving it. ask the client to check his or her spam filter.

If the e-mail is not in the client’s spam folder, please try sending the e-mail again, to make sure that you entered the client’s e-mail address correctly.

Finally, if all else fails, please contact technical support with your name and the e-mail address of the client. We will be able to send the e-mail invitation to the client from here.

If you are not able to send the e-mail, then the client should use the Client Software (not the Web Data Entry), and the client should send the file to you by e-mail (not through our server).

.

In the Client Edition, if the client is using a Macintosh computer, a KeyCode is required. That KeyCode is, in all capital letters,”CLIENT”.

If the client is using Windows, no KeyCode is required for the Client Edition.

If a KeyCode is required in a Windows Family Law Software program, perhaps the client downloaded the Professional Edition by mistake.

On a Windows computer, to uninstall the Professional Edition, the client should click the Windows Start button > All Programs > Family Law Software, > Uninstall Family Law Software.

The client edition may be downloaded here:

Click here to download the Client Edition

There are several possibilities, depending on what method the client was using to enter his or her information, and how he or she sent it to you.

The methods the client could be using are Web Data Entry, or Client Software. We will explore each one.

Using Web Data Entry

This is the online data entry. When the client clicks “Transmit,” the file will be moved to your folder on our server. You then click Files & Settings > Open/Save/Send > Download. If you do not see the data, there are several possible reasons:

1. The client did not actually click “Transmit.” Ask the client if he or she remembers clicking the “Transmit” button. There will be a pop-up message to the client saying that the data has been sent to you. If the client does not remember seeing that message, ask the client to log in again and Transmit the file.

2. Someone from the office already downloaded the file. Once the file is downloaded, we delete it from our server. If the file was transmitted, but you do not see it, ask around the office. Also, click the Open button in the software. Perhaps the file is there in your default folder.

Using Client Software

If your client is using the downloaded Client Software, and the client has sent the file to you, here are the reasons you might not have the file.

1. If the client used “E-mail file to your professional.” If you did not get the e-mail, it is possible that the file got tagged as spam and intercepted. This happens with some regularity, because the e-mail to you is being generated by our software, not by the client by hand. Ask the client to send the file to you “manually.” To do that, the client should follow these steps:

a. Address an e-mail to you, using the client’s regular e-mail software.

b. Attach the file, just the way the client would attach a Word or PDF document. If the client is using Windows, the file will be in My Documents > Family Law Software. Most likely, in the files list, it will have our icon next to the file name. The file name will be the client’s name.

c. Send the e-mail with the file attached to you.

When you get the e-mail, you should download it to your Family Law Software folder. You can find where this is by clicking, in the software, the Files & Settings tab. You will see the path to the folder at the top of the Open/Save/Send screen.

2. File sent through our Server, but e-mail not arrived. If the client used “Send File through our Server,” it is possible that the file was sent, but you did not get a confirming e-mail. Sometimes, the e-mail informing you was tagged as spam, or wound up in your trash folder.Just click Files & Settings > Open/Save/Send > Download. See if the file is there.

3. File sent through our Server, but already downloaded. If the client used “Send File through our Server,” it is also possible that the file was sent, but already downloaded by someone at your office. Once the file is downloaded, we delete it from our server. If the file was transmitted, but you do not see it, ask around the office.

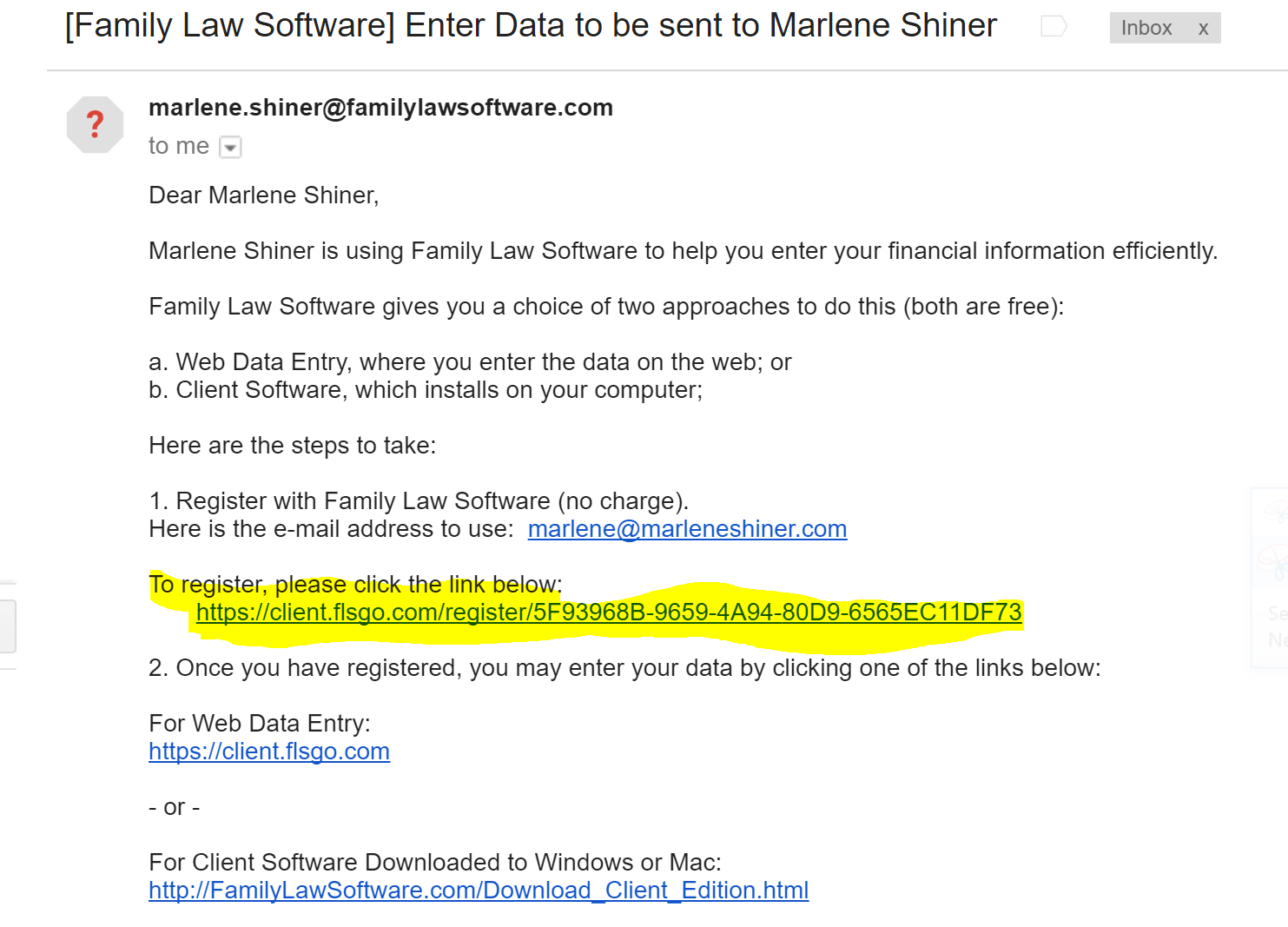

1. You send the client an email from the Client Data > Open/Save/Send > New Client link.

2. The client receives an email asking him/her to register by clicking on a link in the email:

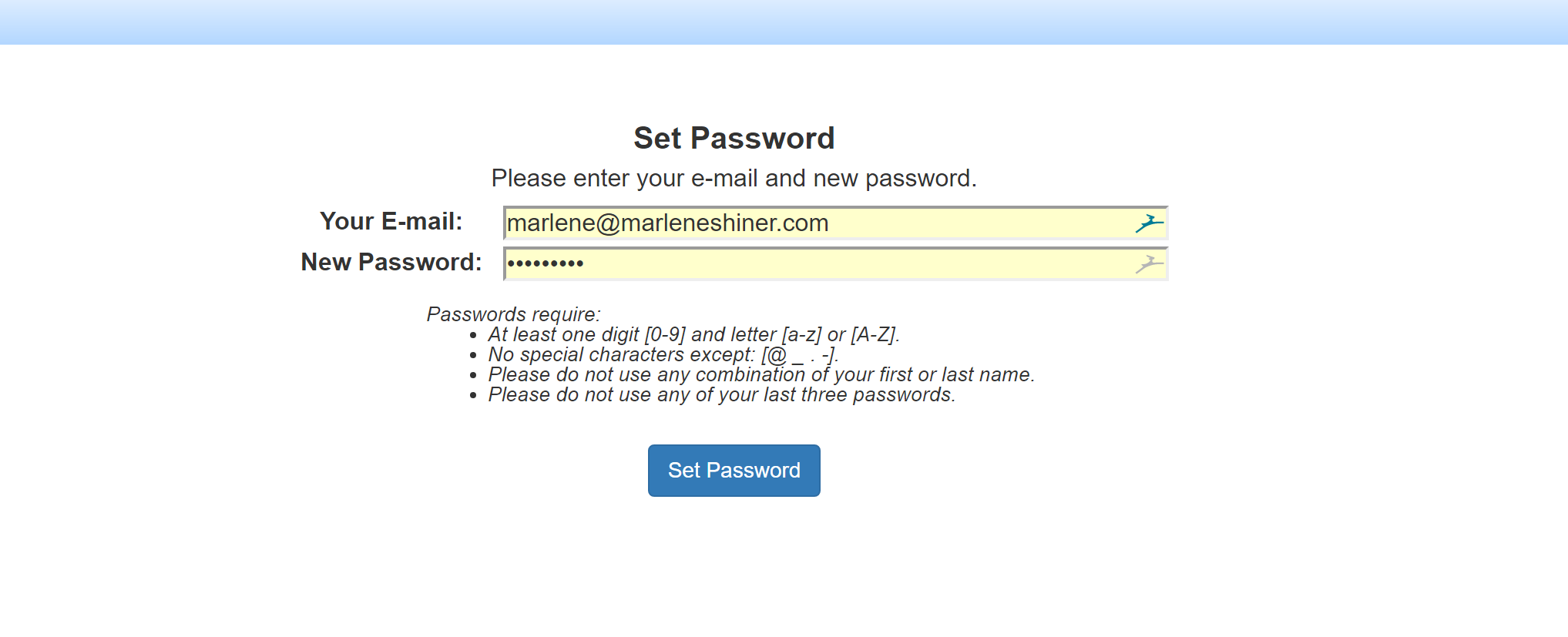

3. This screen comes up and the client enters his or her email and creates his or password:

(The client may also set a new password clicking New Password.)

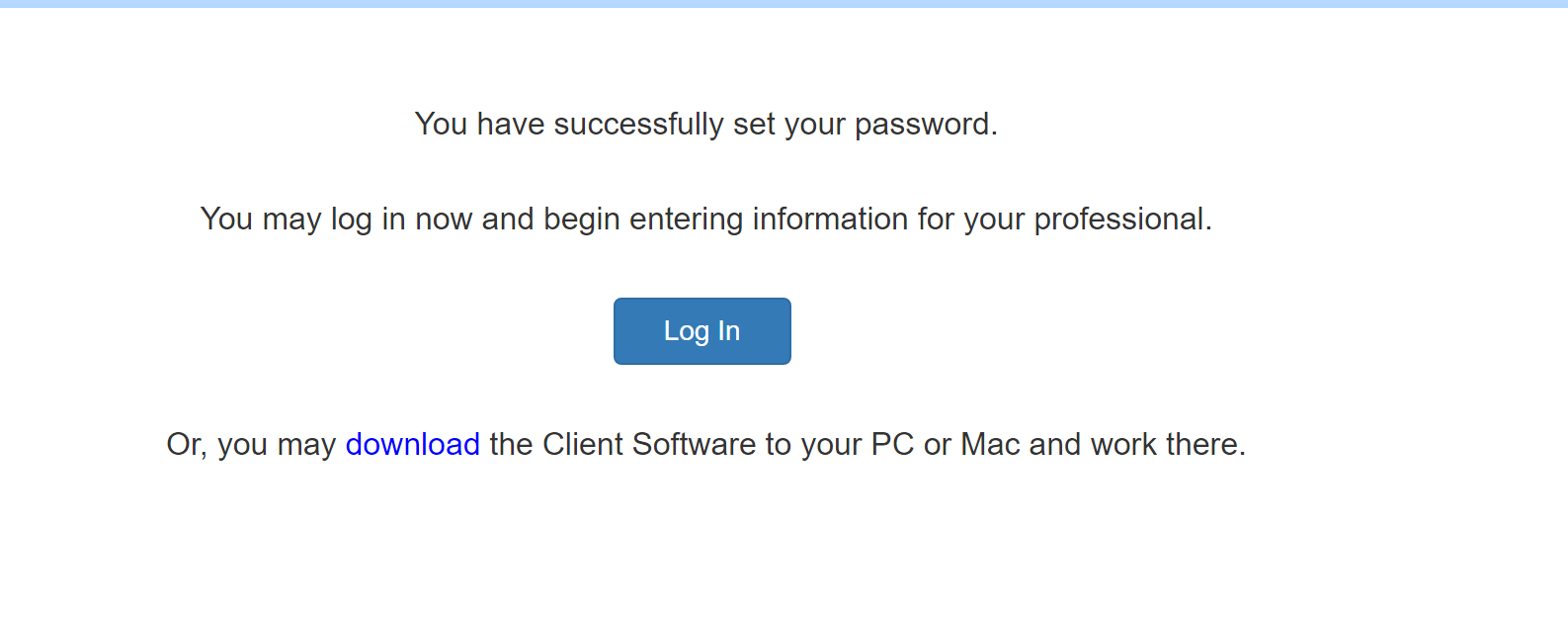

4. The client clicks “Set Password” and this screen comes up, asking the client to Log In:

5. The client logs in again.

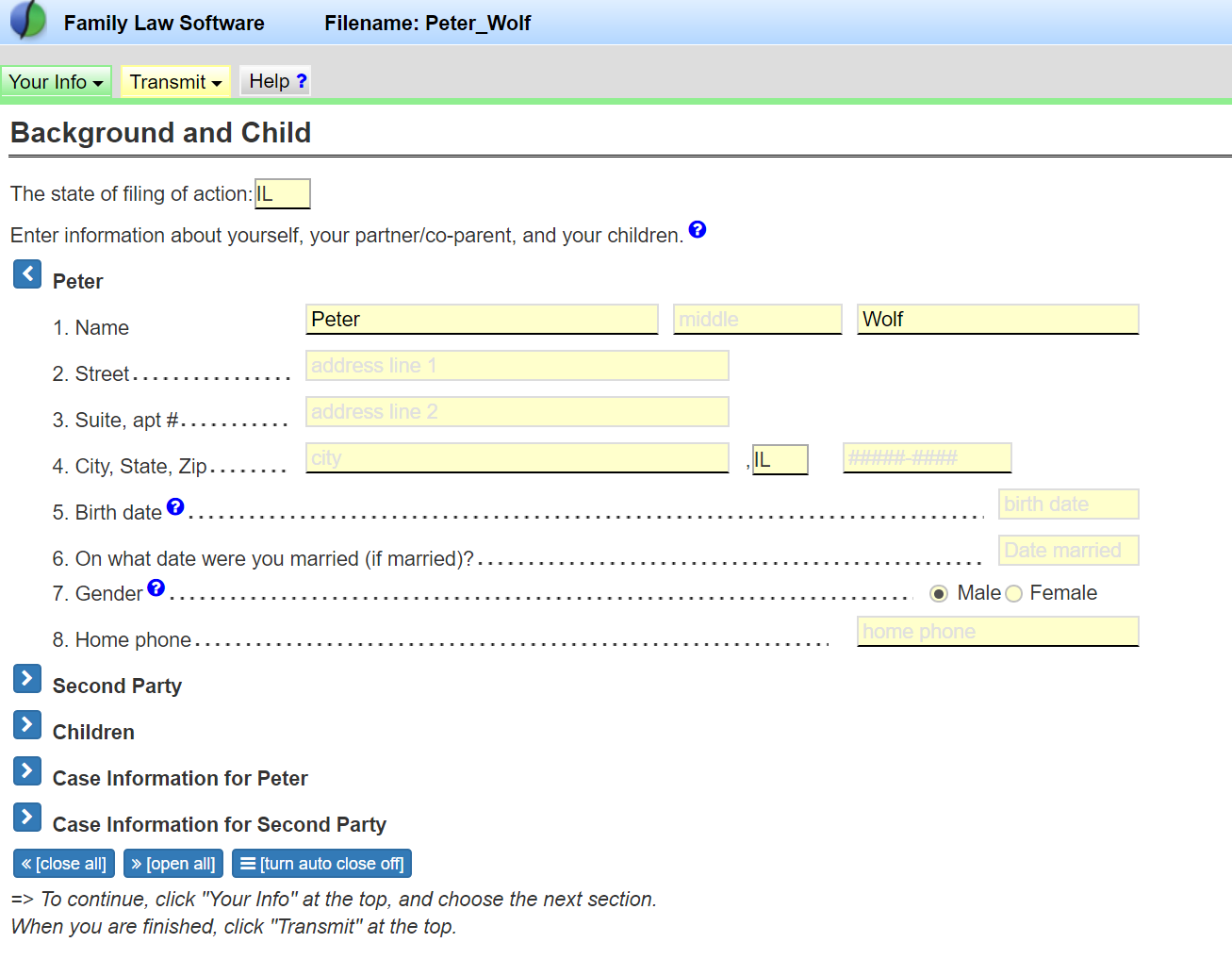

6. Once the client clicks Log In, this screen comes up, and the client begins entering data.

7. When the client is ready, the client clicks Send & Settings > Send File to Pro.

Storing and Sending Client Files

No, the KeyCode only unlocks the software. Once the software is unlocked, the user may open any file created with the software.

This becomes important in situations in which an employee leaves the firm.

If the employee has taken client files with him or her, the employee will be able to access them.

This is true even if we change your keycode.

It is the same as if your employee has taken Word, Excel, or PDF documents with him or her.

The employee can purchase his or her own Keycode to Family Law Software, just as the employee can purchase his or her own copy of Word, Excel, or Adobe Acrobat Reader.

Just as with Word, Excel, or Acrobat, once the software has been purchased, it may be used to open all documents created with the software.

There is no document-level password protection on Family Law Software documents.

In any event, it is not clear that document-level password protection would help in the case of an employee who leaves the firm, because the employee would likely know the password.

Another way to think about this is to be aware that the client files are stored on your computers, not on our server. As a result, we do not have any control over access to those files.

Here is one way to access your files from anywhere:

1. Get Dropbox, Google Drive for PC, Microsoft OneDrive (or a similar service). You would sign up at Dropbox.com, type Google Drive into Google, or search on OneDrive to get started. At this writing, these services are free for a certain amount of storage.

2. Install Family Law Software on computers in all your locations. To do that, get to each computer, go to our home page (www.FamilyLawSoftware.com), click the link to download the latest version, and follow the prompts.

3. On each computer, start Family Law Software, and click Files & Settings > Settings > Change Default Folder. In the dialog box that appears, navigate to your DropBox, Google Drive, or Microsoft OneDrive folder, as your default. Do this on each computer.

When you connect each computer to the Internet, it will synchronize your DropBox, Google Drive, or OneDrive, so changes you make to a file in one location will be downloaded to the next.

So there is nothing you have to do to keep all the computers in sync. It will happen automatically.

In the software, click the PDF button.

Whenever you print to PDF, you will see an option also to send the PDF by e-mail. just specify the email address of the recipient. If there are multiple recipients, separate each email address with a comma.

If a firewall prevents that from working, you can manually send the PDF as an attachment.

The PDF will be saved in your Family Law Software folder.

You can find the location of that folder by looking at the Files & Settings > Open/Save/Send screen, at the top.

Simply address an email to the recipient, and attach the PDF file.

The best way to send us a file is to click Files & Settings > Help/Support > Send us your file.

By default, identifying details will be stripped, and the file will be encrypted before sending.

You may check a box to specify that you do not want to strip identifying details.

You will be prompted to type your question.

If a firewall prevents you from sending the file to us this way, you may manually email us the file.

You can see the folder where the file is located by looking at Files & Settings > Open/Save/Send, at the top of that screen.

Go to your email program, address an email to us with your question, and navigate to that folder to attach the file.

You have several options to move files between computers.

1. Email.

You may use our built in ability to send files from one computer to another.

This is the fastest and easiest way to do it.

To do this, click Files & Settings > Open/Save/Send > Email. Specify your own e-mail address.

When you get to the computer where you want to receive the file, download the file into your Family Law Software folder. (The location of your Family Law Software folder is displayed at the top of the Files & Settings tab > Open/Save/Send screen.).

Then, click the Open button in Family Law Software, find the file, and open it.

2. Copy over a network.

If your laptop is on a network, and you are comfortable copying files from one computer to another, you can just copy the files from the folder where they are being stored to your laptop and back, by dragging them in Windows or using the Mac Finder.

3. Copy using a flash drive.

You may copy the data file onto a flash drive and carry the flash drive to the other computer.

Then copy from the flash drive into your Family Law Software folder on the destination computer.

The best way to send a file is to click Files & Settings > Open/Save/Send > Email.

If a firewall prevents you from sending the file this way, you may manually email the file.

You can see the folder where the file is located by looking at Files & Settings > Open/Save/Send, at the top of that screen.

Go to your email program, address an email to us with your question, and navigate to that folder to attach the file.

There are two approaches:

1. Send the file, and have the attorney download a trial version of the software, which is free.

2. Print what you need to a PDF and send the PDF.

.

To start a new Family Law Software file from within Smokeball, open the Smokeball matter and click the Family Law Software icon at the top of the matter menu bar.

That creates a Family Law Software file.

The file is going to be saved in the default Smokeball location for these files — which is actually a buried temp folder.

In that newly created Family Law Software file, you may click Open/Save/Send > Register Client, to send them the data entry link.

Now, the Family Law Software file will appear in your Smokeball matter > Documents area, but it is empty.

When you get email notification that the client has begun or completed their data entry, you may start Smokeball and re-open the Family Law Software file from within the Smokeball matter.

Then, download the client data file. Now, the Family Law Software file has changed: it has the client’s data.

If you want to enter the data yourself, you can skip the Register Client and Download steps, but just enter the data yourself (or have another member of your staff do it).